From John's Desk …

It’s finally spring here in Minnesota and that bee lawn I planted last fall is showing early signs of emerging. Good. I’m excited to see how it turns out. Let’s get to it.

Earnings and Valuation Challenges

Thanks to tariffs, expect upcoming earnings seasons to include everything and the kitchen sink – a lot of kitchen sinks. Bad in the near term, potentially great a year or so from now when we’re doing our year-over-year comparisons.

This is a gift for companies with some detritus on their books they need to clean up. Now they can do so without anyone the wiser. You know, because of tariffs. Remember something similar a few years ago? Covid. Many companies reported light earnings, you know, because of the pandemic.

During these periods there will be no way to verify whether what the companies are telling you is true. Doesn’t matter, it’s still going to happen. After this current earnings season, which has no tariff impact on the reported results for anyone, get ready for a tariffs overhang for at least the balance of 2025.

How do you make money/avoid losses in this environment? As quality companies go on sale, there will be plenty of ways to make money. I do love buying things on sale! I will post on one of these ideas soon.

As for avoiding losses, one thing that could help is following our warnings on undisclosed SEC investigations. Another is to see if there were any recent comment letters exchanged. Those can contain an abundance of analytically-rich material that can signal trouble ahead. Finally, watch for recent and meaningful board or C-suite turnover.

Few companies will be immune to some kind of pressure because of tariffs. Those that have underlying SEC investigations or recent comment letter challenges are especially vulnerable, if only because they were already distracted by the investigative activity or comment letter requirements. Directors and senior level execs are scrambling for information amidst tariff uncertainty. This is not the ideal time for a new group to be getting to know each other.

Valuation Forecasts – Ignore That Noise Too: Already seeing lots of forecasts out there, trying to give us a sense of how low the market can go (I’ve been around long enough to have lived it – markets can go much lower). Ignore that noise, at least for now.

Here’s why: The ‘E’, earnings portion of ‘PE’ is both unreliable and unpredictable at this time, rendering your forecast useless, if not overstated. This week I saw some estimates that the S&P 500 could see about 7% earnings compression from tariffs. Really? Do you believe tariffs will only hurt earnings by just 7%? Feels too low.

Side note: Last week David Trainer of New Constructs Research had me as a guest on his monthly podcast. We talked about Disclosure Insight’s research process, changes at the SEC, along with a few tips and tricks you can use. You can listen to it here. I start talking about 9 minutes in.

Need a guest on your podcast or speaker at your event? Feel free to reach out. My style is fact-based, yet irreverent and entertaining. We’ll have a good time.

SEC Update

Earlier, I warned of the heightened risk to markets with the SEC now reporting to the White House, its independence having been removed via executive order over the winter. For those who missed it, With Its Independence Removed, the SEC is Now Being Rapidly Dismantled.

Despite DOGE pressure and staff reductions, FOIA requests and replies are still flowing well. However, here’s two ways the SEC’s reporting to the White House is already having a negative impact –

Good luck with that. After widespread accusations were made of possible insider trading last week ahead of Trump’s announcement of a 90 day pause on tariffs, Democrats called for the SEC to investigate the same. The trading patterns do look suspect, and under an independent SEC, such an investigation would likely take place. I think there’s about zero chance that happens now. That’s bad. Letting suspicious trading go unexamined erodes confidence in markets. It also does nothing to deter repeat offenders.

Crypto bros still loving this new SEC they got for their money. It’s well documented that the crypto industry was a heavy donor to Trump during and since the campaign. The family itself is knees deep into all kinds of things crypto (we’ll just look past those pesky, yet glaring conflicts-of-interest).

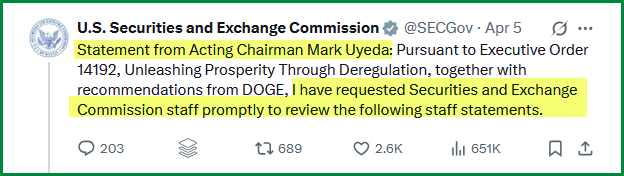

Yet in the midst of a global financial storm triggered by Trump’s tariffs announcements, we get this tweet from the SEC, at a highly unusual time, 11 am, on a Saturday morning, April 5th –

There were six “staff statements” the Acting SEC Chair requested “Commission staff to promptly review”. Five of the six are crypto related. For an agency that’s been around since the 1930s, surely you’d think there are multiple ways for, “unleashing prosperity” that don’t involve crypto.

To this, I tweeted the following in reply –

With so many of its crypto investigations now shut-down, and a regular stream of tweets from the SEC related to crypto, one cannot help but wonder if this SEC tweet was written for an audience of one: Donald Trump. Now how does that protect investors?

We End With a Random Thought …

What happens if a lot of people abandon shipments at the dock? It’s not hard to find videos of small business owners in a panic over tariffs, especially those with shipments inbound from China. Unlike the large companies that can better manage this expense and disruption, many of these smaller companies say they can’t pay the inflated tariffs and are likely to just close their companies, abandoning their orders at the dock.

Imagine that starts happening at scale. Could these abandoned shipments start stacking up so badly that the ports can’t handle it, potentially disrupting supply chains across the country? The biggest inbound ports for items from China and Asia are the two in the Los Angeles area. Watch this space. This could have impact in ways no one’s expecting. Who can make money off docks stacked high with abandoned shipments?

Coming Up:

Last week I attended a joint meeting that my local chapter of the National Association of Corporate Directors held with the local investor relations chapter. I also attended an SEC update webinar hosted by Intelligize, which was aimed at public company accounting and legal people. I have some good takeaways I’ll share next time.

Lastly, while everyone else is watching the yield on 10-year Treasuries, I’m paying closer attention to the spread between high yield credits and treasuries. You can potentially make boatloads of money if things get extreme with high yield credits. I’ll have a brief note coming out soon that will explain how.

That’s all I got for now! Let’s be careful out there. - John

John P. Gavin, CFA, NACD.DC