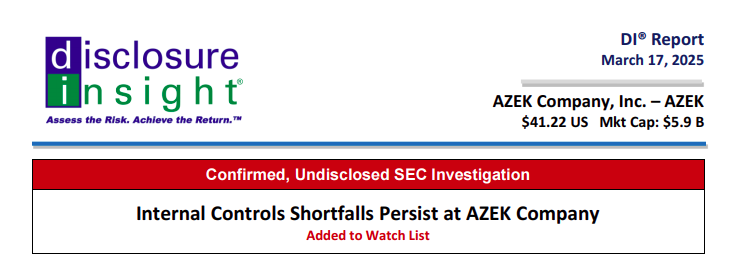

Internal Controls Shortfalls Persist at AZEK Company

NEW: Undisclosed SEC investigation recently found.

A printable PDF version of this report appears at the bottom.

Facts of Interest of Concern: In May 2024, AZEK first announced accounting and internal controls problems that caused income before taxes to be overstated back to 2021. We note the actual restatement says it’s, “for the years ended September 30, 2023, 2022 and 2021 as well as prior periods.” Those prior periods are not identified. [Emphasis added]

The CFO left on short notice, in Jan-2025. He had been in the role since Aug-2021. Per the 10-Q filed in Feb-2025, internal controls were still not effective, as of 31-Dec-2024.

In our work, an early signal of a possible SEC investigation was received on 21-Oct-2024. Signal was then confirmed as an ongoing investigation on 06-Jan-2025. This is a change from a response dated 12-Jan-2024, at which time no signs of ongoing SEC investigative activity were found.

A search of SEC filings, back to the 10-K filed on 29-Nov-2022, found no clear disclosure of SEC investigative activity. We have no documents or meta-data from closed SEC probe(s) of this company. This is the first sign of an SEC investigation we found since we started covering AZEK in Mar-2023.

Notable Items:

8-K filed 08-May-2024: Non-Reliance / Accounting issues first disclosed. From the earnings release, same day –

In the process of closing our fiscal quarter, we identified a discrepancy in an inventory balance. After a thorough investigation, it was determined that a recently departed [but never identified] employee had inaccurately recorded inventory by creating unsupported manual journal entries that ultimately increased the value of inventory and decreased cost of sales. The investigation has been substantially completed, and we have identified the adjustment ranges [that was quick]. These historical adjustments have no impact on net sales or the fundamental strength of our business model or operations. Our growth and productivity initiatives are on-track, and we are confident in our raised outlook. Our core value is to ‘always do the right thing,’ and I am very proud of the team for identifying and immediately addressing this issue,” stated Mr. Singh. [Emphasis added]

NT 10-Q filed 08-May-2024

8-K filed 17-May-2024: NYSE Delisting Notice

10-K/A filed 14-Jun-2024: Restates fiscal years ended Sep-2023, 2022, and 2021. Material weaknesses in internal controls for same periods. 10-Q/A same day.

10-Q filed 14-Jun-2024 : On 14-Jun-2024, AZEK regained compliance with the NYSE listing standards. Disclosure controls and procedures not effective as of March 31, 2024.

10-Q filed on 08-Aug-2024: Disclosure controls and procedures not effective as of June 30, 2024

10-K filed on 20-Nov-2024: Disclosure controls and procedures not effective as of September 30, 2024

8-K filed on 06-Jan-2025: CFO left on short notice. On 06-Jan-2025, AZK announced the CFO was resigning, effective 24-Jan-2025, to pursue another opportunity with a private company. The CFO notified AZEK of his intention to resign on 30-Dec-2024.

10-Q filed on 05-Feb-2025: Disclosure controls and procedures not effective as of December 31, 2024

DI’s Take: Our work suggests AZEK has known about an SEC investigation since at least Oct-2024. Most troubling is the company is now well over three years with material weaknesses in internal controls. Recall, this dates back to at least the fiscal year-end Sep-2021. Not good.

We now point to CEO Jesse Singh’s remarks, back in May-2024, when the non-reliance was first announced. He said AZEK’s, “core value is to, ‘always do the right thing.’”

Uh-huh. Apparently, doing the right thing does not include telling investors there’s now an SEC investigation to go along with protracted internal controls shortfalls.

– John P. Gavin, CFA, NACD.DC

To learn more about our research process, including how to best use this information in your own decision-making, click here.

Our Terms of Service, relevant disclosures, and other legal notices can be found here.