It's Too Late: Your Ship's Not Coming In

The supply chain crisis is here – and it’s just getting started.

From John’s Desk …

“You will not find it difficult to prove that battles, campaigns, and even wars have been won or lost primarily because of logistics.”

– Dwight D. Eisenhower

We’ve crossed the Rubicon on tariffs.

The shipping data are undeniable: the ships aren’t coming in. Like a lava flow, there’s no stopping what’s headed our way – or, more precisely, no quick way to replace what’s not coming.

Cargo vessels arriving at U.S. ports – especially in California, where most imports from Asia land – have declined sharply and are expected to get worse. The die is cast. There’s no turning back, at least not quickly. If you haven’t started stocking up on essentials yet, now’s the time. Batteries, seriously.

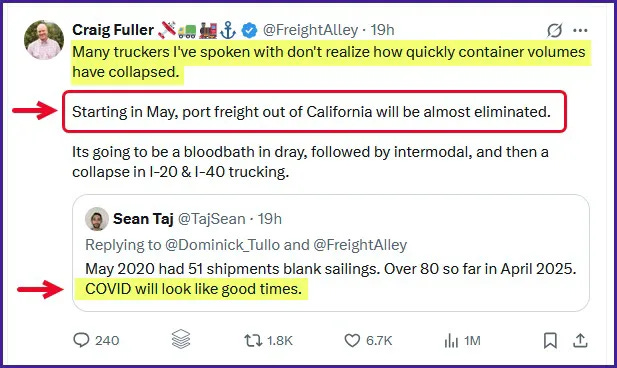

Sure, markets continue to cheer every morsel of “tariff hopeium” from the White House – those recurring, always-optimistic promises of trade breakthroughs. But logistics experts, industry leaders, and supply chain pros have been sounding the alarm for weeks. Their message is consistent, well supported by easily observable data, and has grown more urgent: We’re facing supply chain disruptions on a scale not seen since the pandemic – and likely worse.

How can the stock market thrive if warnings of severe supply chain disruptions come to fruition? It can’t and it won’t. We have some rough water ahead.

So what’s going on?

Uncertainty over tariffs has caused businesses to dramatically reduce or stop ordering products from overseas. In the unlikely event the president fully reverses his ill-advised posture on tariffs, one expert recently told Fortune it would take two months for supply chains to be restored from here. Others have said much longer, depending on the products and factories that produce them.

“Even if the president said, ‘Oh, this was for nothing; we’re going to stop the trade war; everything’s back to normal,’ it’ll still take two months for things to get back to normal.”

Dean Croke, principal analyst for freight data and analytics at DAT, told Fortune.

Trucking and land-based freight are already slowing sharply. The disruption goes beyond ships sitting offshore – or not sitting offshore, as is our growing problem. Container traffic at the Port of Los Angeles, the nation’s busiest, has dropped about 20% year-over-year, with industry insiders warning the worst is yet to come.

How are you supposed to plan or price your products? You own a business importing heavily from China, where today’s tariff of 145% could suddenly drop to 10% tomorrow with a late-night tweet.

Businesses are stuck, scrambling for costly workarounds instead of doing what they do best; you know, running their operations and making money. Social media is full of videos showing distressed small business owners fearful they may have no choice but to close their companies. Some said they will simply close shop, abandoning shipments at the dock - an added complexity to the logistics mess. Soon.

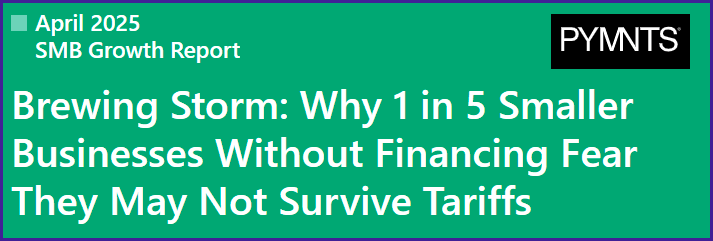

These aren’t just sob stories.

Small businesses employ nearly half the U.S. workforce and contributes roughly 44% of GDP. In April, PYMNTS Intelligence posted a report that 1 in 5 smaller businesses without financing may not survive tariff-related pressures. This is the type of economic and social harm that could last for years.

It appears they have no plan. At this point, the president and his team can say or do whatever they want on trade. They can tout the brilliance of their strategy, and continue to promise “deals” are imminent. Some of that may even be true. But none of it changes this stubborn fact: It appears they have no plan. No key metrics have been provided to let us measure the supposed success of the new tariffs regime.

Business people are past talk – they need results.

Instead, they get an administration that appears to be making it up as they go along, resulting in mixed messaging that confuses markets and businesses alike. Worse, those across the trade negotiating table see it clearly and are exploiting it to our disadvantage.

Experts warn shelves will start getting thinner as soon as early summer, with back-to-school season especially at risk. The Christmas shopping season will have a whole different feel to it if tariff pressures aren’t eased next month. The month of May is when most retailers need to place their orders for holiday merchandise to have it arrive in time.

Unrelated but equally concerning, student loan collections resume in May. There are over 5 million Americans already in default, with millions close behind. People need to repay their debt, and failure to enforce that creates its own set of problems. However, these consumers will soon face threats of wage garnishments and tax refund seizures just as tariff-driven price increases ripple through the economy. Housing, auto loans, travel, and other sizable economic drivers are also showing troubling signs. All these pressures are converging simultaneously.

As for markets? Traders love volatility, so markets will keeping taking the bait – until they won’t. As I’ve said throughout my investing career, opportunities exist in every market environment. Eventually, more great companies and assets will likely go on sale in the coming months, many at fire sale prices. Watch for them. Your next inflection point will likely come when nightly news is filled with stories of empty shelves, layoffs, business closures, and angry consumers.

A final, personal observation: Like many who make their way in life, I grew up in a working class family that lived on the edge financially. As a volunteer first responder, for decades I went into the homes of people doing the same. As a business owner, 50 of the employees from a company it took me a decade to build all lost their jobs in one fell swoop when our primary financial supporter had its own problems and backed away. I know the grittier side of our economy because I’ve lived it. These are my people from where I came. They are the people who truly make this country great.

Thanks to tenacity, hard work, and the opportunities available growing up, the analyst in me can now look ahead at possible investments I can make. But that working class kid in me looks ahead with dread and concern over a disaster of our own making. Congress holds the constitutional authority to regulate foreign commerce and impose tariffs. It’s well past time they assert it.

For now, batten down the hatches. And stock up on batteries and other things you might need while you can. There’s no stopping the storm that’s about to hit. - John

John P. Gavin, CFA, NACD.DC

Incredible post!