John's Desk: Investors Are Starting to Notice

Pardons and dismissals of fraud cases coming faster than expected.

From John’s Desk …

"Corruption, embezzlement, fraud, these are all characteristics which exist everywhere ... What successful economies do is keep it to a minimum."

- Alan Greenspan, in an an interview, September 24, 2007

Get Out of Jail Week for the Convicted

Fraudsters—both convicted and under investigation—are walking free, thanks to SEC case closures and a flurry of presidential pardons. Investors are starting to notice, with many voicing their displeasure over what they see.

This is moving faster than expected when I warned about this very risk in my piece published a couple weeks ago, With Its Independence Removed, the SEC is Now Being Rapidly Dismantled.

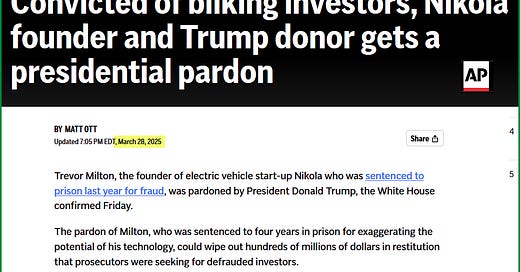

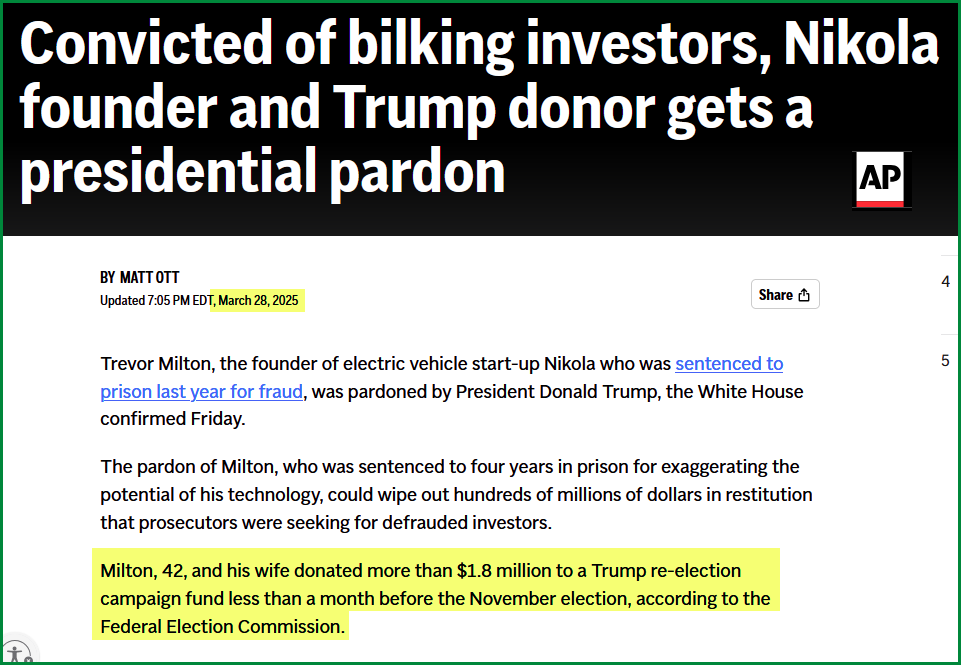

Donald Trump’s surprise pardon of Trevor Milton, of Nikola fame, angered investors last week. On the Twitter machine, I noticed the outrage and disgust over this pardon was coming from both sides of the political aisle. Clearly, Milton’s pardon did not land well on Wall Street.

Trevor’s Take: Taking no accountability for his actions,Trevor uses the word ‘misunderstanding’ a lot in this clip from a Wall Street Journal interview the day after receiving his pardon.

John’s Take: Trevor Milton is the poster child for the danger capital markets now face from donor influence and political meddling. A lot of investors, of all political leanings, are upset about this pardon. Few are buying his "I'm a victim" noise. They don't like seeing fraudsters cut loose. Neither do I, and we’re having an abundance of them right now. With its independence recently removed, and the SEC now reporting up to the White House, we can expect there will be others.

It’s Not Just Trevor Milton Getting Cut Loose

Since Inauguration Day in January, the President has issued pardons or commutations in his second term for six people convicted of financial or fraud-type crimes. Five of them took place just last week.

Just this past week - -

Trevor Milton: Nikola Corporation founder, convicted in 2022 for misleading investors about hydrogen truck technology. Was sentenced to 4 years in prison and a $1 million fine in 2023. He had yet to report to prison at the time of his full pardon on March 27, 2025.

The three co-founders of the BitMEX cryptocurrency exchange: In 2022, all pled guilty to violating anti-money laundering and related rules. All three received probation, with one receiving six months home confinement. Each also had to pay a $10 million fine. All three pardoned fully on March 27, 2025.

Carlos Watson: Ozy Media co-founder, convicted in 2024 for defrauding investors of over $60 million. On the very day he was to report to prison, March 28, 2025, Trump commuted his 116-month sentence to time served.

Side note: Last week Edwin Dorsey of The Bear Cave hosted me for a Twitter Spaces interview. We talked about Disclosure Insight’s research process, changes at the SEC, along with a few tips and tricks you can use. You can listen to it here.

Need a guest on your podcast or speaker at your event? Feel free to reach out. My style is fact-based, yet irreverent and entertaining. We’ll have a good time.

Crypto Bros Still Celebrating Too

After having heavily donated to the Trump campaign, the crypto bros are loving this new SEC they got for their money. Under new leadership, the SEC wasted no time in shutting down a wide array of investigations in that space and promised a light touch on things crypto going forward.

Even as recently as last week, SEC investigations of possible securities fraud at crypto companies continued to be closed without further action.

This change in emphasis is not out of the ordinary when a new president comes into office. New president, new priorities. Everyone knows the rules.

But are we throwing out the baby with the bathwater? Under what appears to be an, “all crypto investigations bad” standard at the SEC, Sam Bankman-Fried, FTX’s founder, would still be free. Instead, this former crypto billionaire is serving a 25 year prison sentence for his role in the 2022 collapse of FTX.

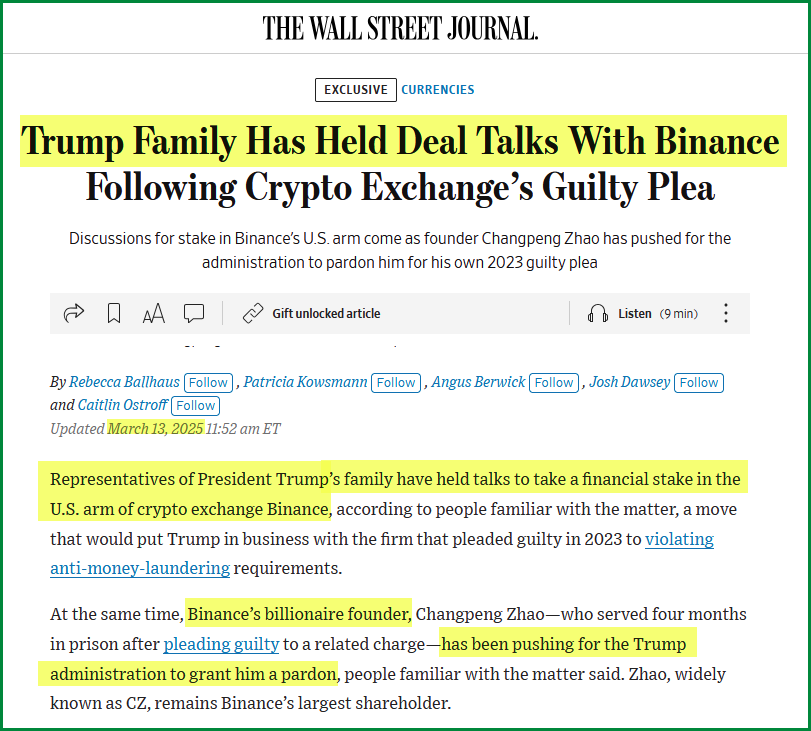

Further, questions of motive and intent will come up anytime we see headlines like the following:

There may be legitimate reasons for pausing or ending any investigation. But now some of them come with questions that would not have likely arisen had the SEC remained a fully independent agency.

The shifts in sentiment among market players I discussed earlier are worth noting.

Suggestions - even hints - that pardons and reduced enforcement efforts are the result of campaign contributions or other financial gain for those in charge are troubling. To the extent they continue, and depending how egregious they become, investors will start to lose confidence in capital markets, which could potentially impact your wealth.

We're facing unprecedented challenges in U.S. capital markets. Let’s be careful out there. - John

John P. Gavin, CFA, NACD.DC