With Its Independence Removed, the SEC is Now Being Rapidly Dismantled.

Sweeping changes at the SEC create challenges and new risks for capital markets. Investors largely unaware.

From John’s Desk …

"The SEC's independence is essential to its ability to effectively regulate the securities markets and protect investors … without fear of political interference or reprisal."

Source: Jay Clayton, SEC chair, Trump’s first term

Remarks at the Economic Club of New York

September 09, 2019

US Capital Markets in Uncharted Regulatory Waters Now

So much has happened at the SEC, in such a short period of time, that few market participants are even aware of the many changes impacting the agency now. This all since Donald Trump came back into the White House.

Some of what we alert you to here could be overturned by the courts, but that is not a certainty. What is certain is this: The SEC’s ability to function will be greatly diminished, introducing risk and uncertainty to capital markets that will last for years to come.

No matter your personal politics, if you participate in US capital markets, in any way, you will be impacted by this. We brief you here.

The SEC will no longer operate like it did before Inauguration Day 2025.

It can’t.

Too much has changed since then.

To be clear, what is taking place at the SEC right now is not like those changes that typically occur with each new change in administration. Different president, different priorities. We get it. No, what’s taken place at the SEC in recent weeks is of an unprecedented scale that most capital market participants will find unsettling.

From its inception in the 1930s, and as clearly expressed in the related legislation, Congress designed the SEC as a bipartisan, expert, and independent agency. That’s gone now. Donor influence and political meddling have entered the chat.

The changes we list for you below go much further than the SEC now reporting up to the White House. The related executive order that took away its independence was quickly followed by a series of debilitating cuts in personnel and facilities. Picture this: If the SEC were an automobile, you’d have a car that still looks the same but sputters and barely drives because so many of its systems and parts got removed.

Securities Laws Have Not Changed: There Will Now Be Less Staff and Resources to Enforce Them.

They’re Not Telling You This Part

The rules haven’t changed. Public companies still need to make their filings on time; initial public offerings (IPOs) still need to be reviewed; investment firms still need to be examined; novel investment products will still emerge; and, financial turmoil will surely occur again. The legislatively required oversight and establishment of boundaries that come with all of the above will now be done with reduced staff and resources. Something’s gotta give.

Just Since Inauguration Day …

As we said above, what the new president has done with the SEC is unprecedented - and will hurt its capacity to regulate markets for years. Let’s go through it chronologically.

In early February, the Trump administration made it harder for the SEC to open formal investigations. This is expected to impede enforcement of securities laws.

In mid-February an Executive Order took away the SEC's independence.

On February, 18, 2025, by executive order, the SEC’s capacity to function as an independent agency was removed. Poof! Gone. Just like that.

Now, for the first time since it was established, the SEC will be overseen by unidentified staff at the White House Office of Management and Budget (OMB), who have qualifications and expertise unknown.

With the ink barely dry on the order, Elon Musk’s DOGE crew of 20-somethings was inside the SEC. The agency’s remaining capacities were then meaningfully reduced and/or compromised. This continues as we go to print. Here’s what we could glean from public sources -

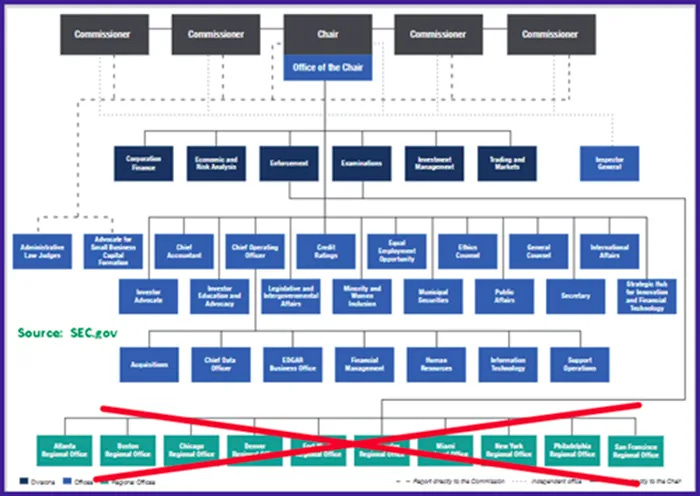

Regional directors across 10 SEC field offices to be fired. This removes the executive leadership of an entire level of the SEC’s organization chart. More importantly, in one fell swoop the SEC stands to lose untold decades of knowledge, expertise, and institutional memory.

SEC field offices in Philadelphia and Los Angeles to close. They wanted to close the Chicago office as well, but that effort failed, hitting contract termination problems.

$50,000 buyout offers have been made to all eligible SEC employees encouraging them to resign by April.

Interesting side note: SEC employees are getting a better offer than those working for the Department of Health and Human Services. News reports as we go to print tell us HHS is only offering a $25,000 buyout to most of its workers.

The United States has the strongest capital markets in the world. That’s now at risk.

While not perfect, investors trust US capital markets. Until now the US regulatory environment for investors and registrants was robust, predictable, and generally free from political interference. This helped maintain the confidence of investors which, in turn, lowers the cost of raising capital here. Few realize the positive impact an independent SEC had on maintaining this system. Losing that won’t be free.

If there’s anything markets hate, it’s uncertainty. Well, markets are being served up boatloads of uncertainty now. US capital markets have never experienced the systemic risk that comes with suddenly removing the independence of, and then weakening its primary regulator, especially over a period of just a few weeks.

Worse, there are related risks that will show up unexpectedly, making them hard to assess, hedge, or discount.

Pay attention. Get yourself current on the changes taking place at the SEC. Even within a disrupted regulatory regime, there will still be plenty of opportunities to make money. You may need to adjust your thinking to find them. While you’re at it, you probably should give higher mind share to avoiding losses than you might have in the past.

Remember: Serious investors don’t make excuses.

Serious investors figure out how to make money and avoid losses in any market or political environment. My commitment to help you do that has not changed.

I’ll keep you updated. - John

John P. Gavin, CFA, NACD.DC

direports@disclosureinsight.com

The SEC has done such a bad job over DECADES in terms of reforming and updating normal activities in capital markets. Look at how stagnant the IPO process has been! That's an area where I've been active since 1995. I like to see strong regulation against fraud and to ensure transparency but maybe we need to start over and build a new SEC from first principles.

Glad to see reductions. The best police force for the market is, well, the market.